A Record Number of Home Sales Fell Through in June – CNET [CNET]

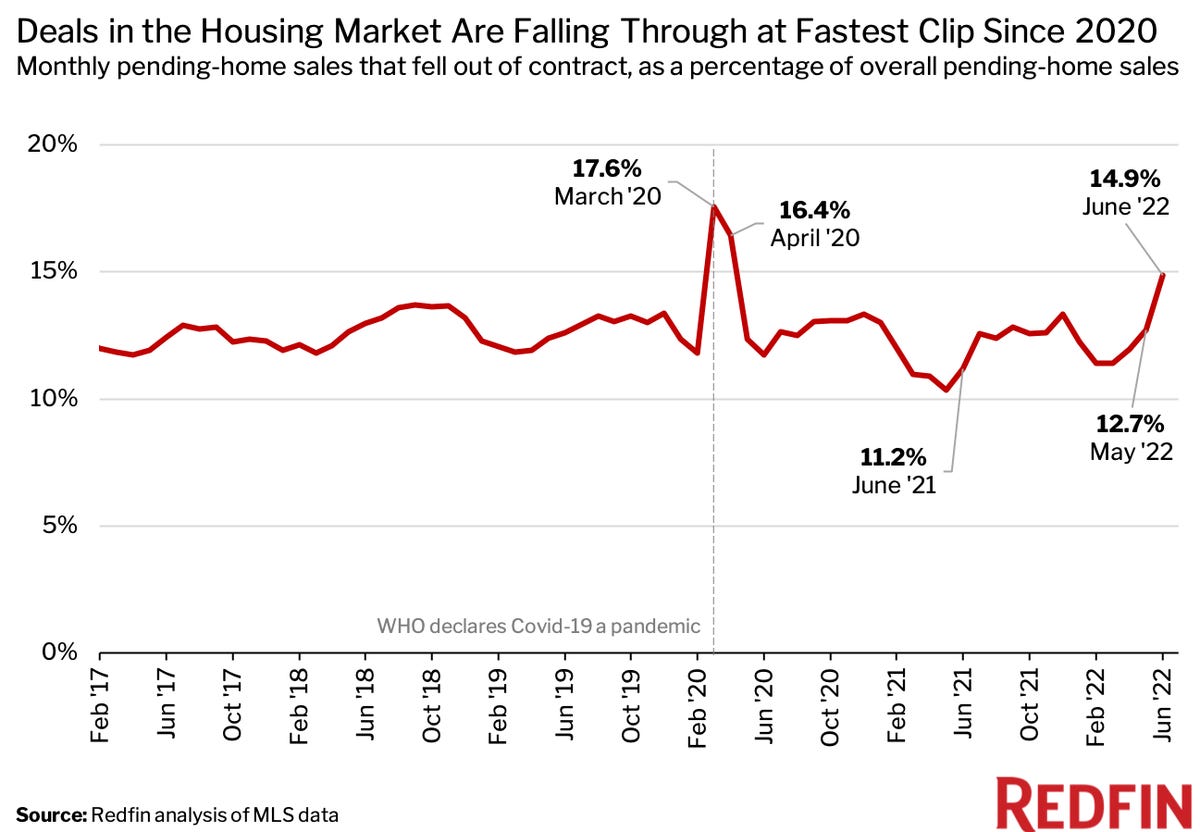

Redfin analyzed data from the last three years and found that the current 14.9% cancellation rate is second only to the 17.6% cancellation rate that occurred in March 2020, when the pandemic all but halted the housing market. The previous month’s rate for May was 12.7%, and the previous year’s rate for June 2021 was 11.2%.

While there are many reasons why these deals may have fallen through, it’s likely that rising inflation and mortgage rates have complicated the home buying process for many people. The Federal Reserve has increased interest rates three times this year in an attempt to tame inflation. The federal funds rate, which is the interest rate banks charge one another for borrowing and lending, now sits at a range of 1.5% to 1.75%

Mortgage rates, which are the percentages of interest a lender assigns to a homeowner loan, have also been rising. Both 15- and 30-year fixed mortgage rates have been increasing since the beginning of 2022, and even a slight increase in mortgage rates could cost a potential homeowner thousands of dollars.

![a-record-number-of-home-sales-fell-through-in-june-–-cnet-[cnet]](https://i0.wp.com/upmytech.com/wp-content/uploads/2022/07/76399-a-record-number-of-home-sales-fell-through-in-june-cnet-cnet.jpg?resize=800%2C445&ssl=1)

![what-is-dwell-time?-is-dwell-time-a-google-ranking-factor?-[readwrite]](https://i0.wp.com/upmytech.com/wp-content/uploads/2020/07/6316/what-is-dwell-time-is-dwell-time-a-google-ranking-factor-readwrite.jpg?resize=390%2C205&ssl=1)

![the-far-side-cartoonist-gary-larson-debuts-first-new-comics-in-25-years-–-cnet-[cnet]](https://i0.wp.com/upmytech.com/wp-content/uploads/2020/07/4781/the-far-side-cartoonist-gary-larson-debuts-first-new-comics-in-25-years-cnet-cnet.jpg?resize=300%2C205&ssl=1)

![samsung-sold-more-foldables-in-galaxy-z-fold-3’s-launch-month-than-in-all-of-2020-–-cnet-[cnet]](https://i0.wp.com/upmytech.com/wp-content/uploads/2021/12/47064-samsung-sold-more-foldables-in-galaxy-z-fold-3s-launch-month-than-in-all-of-2020-cnet-cnet.jpg?resize=390%2C205&ssl=1)